The Church Pension Group (CPG) depends on investment returns to cover the full cost of the benefits, programs, and services we offer. Professionalism, diversification, and a long-term focus are critical to our success.

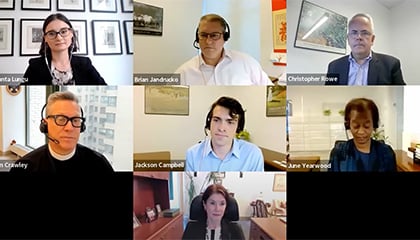

Our investment professionals bring decades of experience, passion for their work, and diverse perspectives to their shared responsibility of overseeing CPG’s investments.

Specialized groups within the team oversee individual asset classes, regional investments, and other functions, including operations and risk. All this experience informs our work selecting and monitoring outside investment managers and mitigating global investing risks.

In building portfolios, we work with experienced external managers rather than selecting specific investments ourselves. We hold these managers to high-performance standards because strong, risk-adjusted returns make all our work possible.

Our socially responsible investing strategy pursues impact investments, engages with companies in our portfolio, and brings a broad analytical lens to our process to benefit the people we serve and the values we hold in common with The Episcopal Church.

Benchmarks and Performance

Explore The Church Pension Fund’s asset distribution, success relative to key benchmarks, and historical investment performance.

Investment Team

Our investment professionals bring deep experience and wide-ranging expertise to managing The Church Pension Fund’s assets. They focus on our collective long-term goal of meeting the pension and benefit needs of those who serve The Episcopal Church.

You will be redirected to a new tab for live remote support. Please confirm you're on a call with a Client Services team member to continue.